Financial markets thrive on basic human emotions such as fear and greed. Market cycles and price patterns have repeated for decades and are likely to occur again.

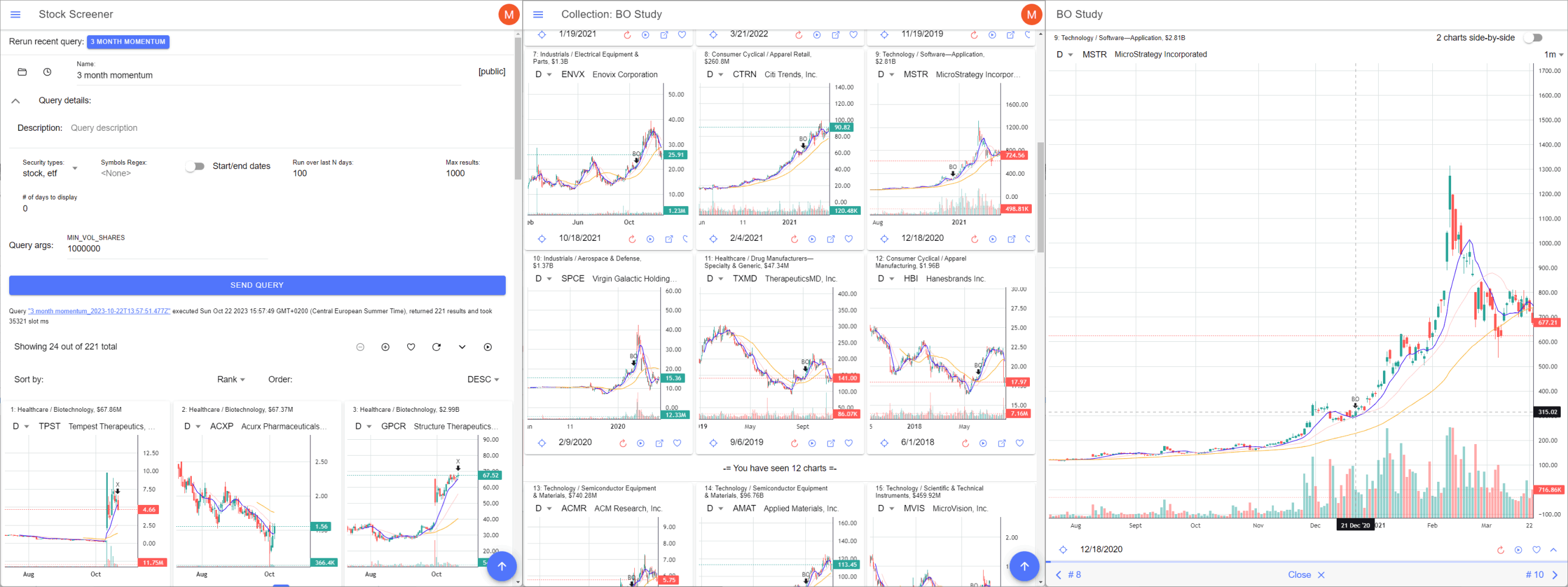

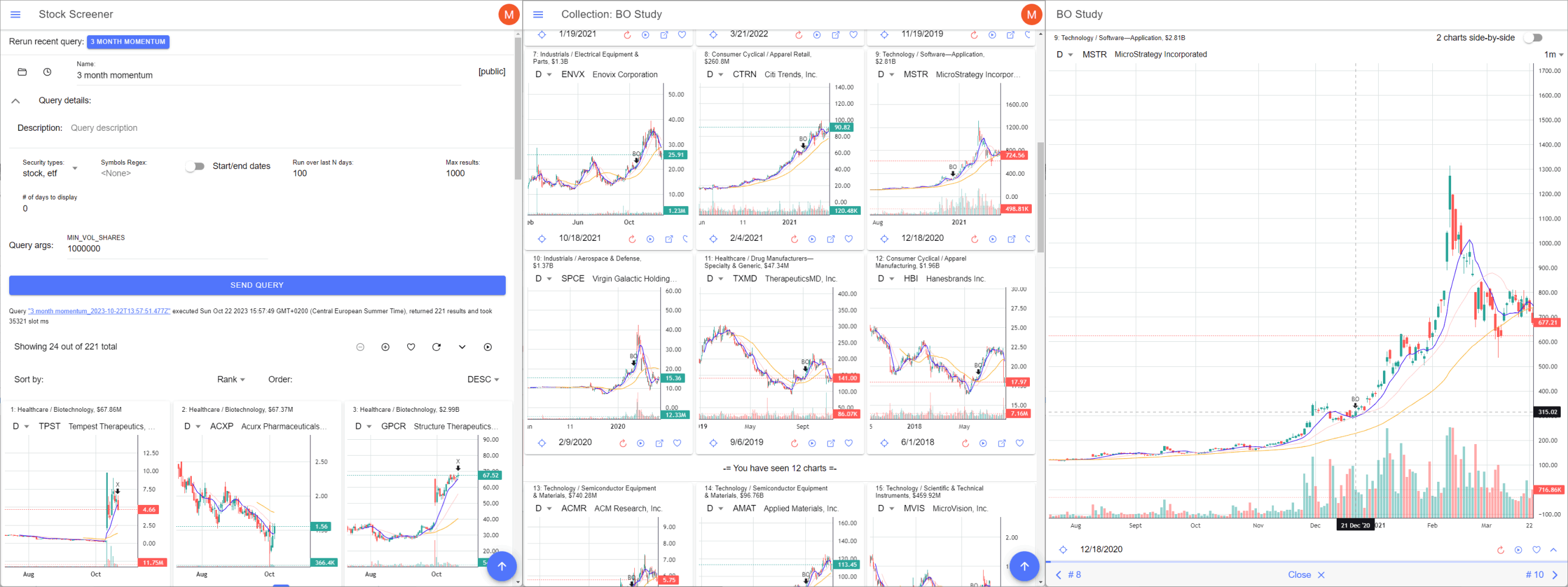

A comprehensive and easy to use suit of tools to study stock price behavior.

Clean interactive charts

Focus on what matters: price and volume.

Bar by bar replay

Simulate real processes and challenge your decision making.

30+ years of weekly and daily US stock data

Find relevant daily setups, then drill-down into intraday charts (up to 1 min resolution in the last 15 years).

Study on the go

Works on desktop and mobile, do your research anywhere whenever you have time.

Swing trading is scalable

Small to medium accounts are less affected by slippage and liquidity because they typically use larger stop losses, hence they need less shares for the same dollar risk amount.

Higher reward potential

Real market leaders can double and triple in price, but it takes days to weeks to months for the price to develop.

Less stress

You have more time outside of market hours to find trading opportunities and make decisions.

Less noise

HFTs and other active market participants are irrelevant when you don’t focus on intraday price fluctuations.

Easier to combine with a regular job

You don’t have to be glued to charts during the workday. Make your game-plan the day before or on the weekend, then simply execute if your setup triggers.

YES! Never trade in a vacuum! Looking at a higher time frame will give you the bigger picture.

US market provides the largest number of companies to choose from, great liquidity and outstanding volatility, all important requirements for trading:

“The U.S. equity markets are the largest in the world and continue to be among the deepest, most liquid and most efficient, representing 42.5% of the $108.6 trillion global equity market cap in 2023, or $46.2 trillion. This is 3.8x the next largest market, EU.” [citation].

$0

No credit card required

AI Website Generator